siniymedved.ru Recently Added

Recently Added

The Best Place To Refinance Your Car

Rates as of Sep 07, ET. Disclosures and Definitions Advertised “as low as” annual percentage rates (APR) assume excellent borrower credit history. Your. Refinance Your Car. Save Time and Money With Auto Approve! We Make Auto Refinancing Painless With Lowest Rates. Get a Free Quote Today! I went on my local credit union's site and compared their auto loan rates (couldn't find the CU's refinance rate) and they start at % for new. Refinance your car loan through Upstart and save on your monthly car payments. Check your rate in minutes — without impacting your credit score. Refinancing your auto loan could help you lower your monthly payment by providing a better interest rate or changing the length of your loan. How LendingClub Bank Auto Refinancing Works · Check Your Rate. Tell us a little about yourself and your vehicle, and, if you qualify, you'll receive multiple. Credit unions own most of today's auto refinance market, according to the credit bureau TransUnion. These financial institutions generally charge lower rates. Apply for financing in advance. Credit unions are best. Credit unions may have used vehicles they've previously financed. Large down payments. She got a letter from a company called iLending offering a refinance but wanted to know which companies the reddit liked. Rates as of Sep 07, ET. Disclosures and Definitions Advertised “as low as” annual percentage rates (APR) assume excellent borrower credit history. Your. Refinance Your Car. Save Time and Money With Auto Approve! We Make Auto Refinancing Painless With Lowest Rates. Get a Free Quote Today! I went on my local credit union's site and compared their auto loan rates (couldn't find the CU's refinance rate) and they start at % for new. Refinance your car loan through Upstart and save on your monthly car payments. Check your rate in minutes — without impacting your credit score. Refinancing your auto loan could help you lower your monthly payment by providing a better interest rate or changing the length of your loan. How LendingClub Bank Auto Refinancing Works · Check Your Rate. Tell us a little about yourself and your vehicle, and, if you qualify, you'll receive multiple. Credit unions own most of today's auto refinance market, according to the credit bureau TransUnion. These financial institutions generally charge lower rates. Apply for financing in advance. Credit unions are best. Credit unions may have used vehicles they've previously financed. Large down payments. She got a letter from a company called iLending offering a refinance but wanted to know which companies the reddit liked.

Are you refinancing your car? Get a low and competitive rate on auto loan refinancing at Truliant! Lower your payments, auto refinancing can help you! Refinancing your vehicle with Ally could help lower your monthly payment. Find out in minutes if you pre-qualify with no impact to your credit score. RefiJet offers nationwide auto loan refinancing. Save money on your car loan with our expert services. Plus, Old National accountholders are eligible for a % auto loan discount A man driving his car. GREAT SERVICE – AND A LOWER MONTHLY PAYMENT*. A banking. Want to save on your auto insurance payments? Or need to extend the term for lower payments? Learn how to refinance your loan. In our review of vehicle loan lenders, we found the best auto refinance companies to be Auto Approve, myAutoloan and PenFed Credit Union. What you get with every OneMain auto refinance loan · Icon showing a dollar bill with a stop watch. Money right when you need it. Quick decision. · Icon showing. Auto Refinance Loans. Same car. Better loan. Take advantage of low rates. Apply for car loan refinancing today! Best Companies to Refinance Your Auto Loan · RateGenius – Best for bad credit · Lending Tree – Best for no credit or new credit · MyAutoLoan – Best auto refinance. Time for a better deal by refinancing your car loan. Easy to move your loan A refi can help you get a lower car payment. Quick application 1. When it. With auto loan refinancing from PNC, you can refinance a car loan at a lower interest rate. Learn how it works and apply online today! Best Overall: PenFed · Best Big Bank: PNC Bank · Best Refinance Loan Marketplace: AUTOPAY · Best Credit Union: Consumers Credit Union · Best Online Lender. Need to refinance your car? Credit union refinancing can give you a lower monthly payment and a better interest rate. Beat the rates of the best auto. Best Auto Loan Refinance Lenders of August · Best Overall: myAutoLoan · Best for Skipping Payments: Gravity Lending · Best for No Origination Fee: LendingClub. Alliant Credit Union – Refinance loan · Digital Federal Credit Union - Refinance loan · PenFed Credit Union - Refinance loan. The pros and cons of cash. Get more with Bank of America auto refinance loans · day rate lock guarantee · No fee to apply for your refinance loan · Manage all your BofA accounts in one. Save an average of $ by refinancing your vehicle at UW Credit Union You need to feel confident that you picked the best option for your vehicle loan. Perks of Refinancing Your Car Loan ; percentage icon. Lower Interest Rates ; location icon. Trusted Local Lender ; money icon. Cash-Out Refinance. If you took out your initial loan through dealer-arranged financing, refinancing with a different lender could get you a lower rate. Bankrate tip. Use a car. Auto refinance loans are available on siniymedved.ru, which is operated by Upstart Network, Inc. ("Upstart"). Loans are originated by its network of lenders and.

Sears Mastercard Benefits

How do I earn Cash Rewards? Once you are enrolled, you earn rewards on eligible purchases 1% Cash Rewards on Sears purchases, 5% Cash Rewards at gas stations. No, it does not offer a rewards program. What are the Sears Card® benefits? Piedmont Advantage CU Mastercard Credit Card · Piedmont Advantage CU. The benefits seem decent for being a no annual fee card: 5% in points on Gas, and 3% on points on Restaurants and Grocery Stores. (Subject to a cap of 10k/yr). Sears offers a store credit to encourage loyalty purchasing, aka repeat buyers, but these are not cards to get a cash advance or to shop. How do I contact Citi ThankYou Rewards if I have questions regarding my ThankYou account or my Citi credit card? Customers with cards issued in the US. I have had this credit card since and it is the most lucrative card if taking advantage of the 10 - 25% back in points promotions that they. So your total rewards would be like 15% on gas, 13% on grocery, and 13% on dining on up to $ in purchases for the month. These offers lasts. The Sears Credit Card offers a mix of advantages and limitations. While it provides unique discounts, rewards, and financing options for loyal customers, it. The Sears Credit Card rewards are 10 - 50 points per $1 spent, depending on the type of purchase. Cardholders also earn a $75 statement credit for every $ How do I earn Cash Rewards? Once you are enrolled, you earn rewards on eligible purchases 1% Cash Rewards on Sears purchases, 5% Cash Rewards at gas stations. No, it does not offer a rewards program. What are the Sears Card® benefits? Piedmont Advantage CU Mastercard Credit Card · Piedmont Advantage CU. The benefits seem decent for being a no annual fee card: 5% in points on Gas, and 3% on points on Restaurants and Grocery Stores. (Subject to a cap of 10k/yr). Sears offers a store credit to encourage loyalty purchasing, aka repeat buyers, but these are not cards to get a cash advance or to shop. How do I contact Citi ThankYou Rewards if I have questions regarding my ThankYou account or my Citi credit card? Customers with cards issued in the US. I have had this credit card since and it is the most lucrative card if taking advantage of the 10 - 25% back in points promotions that they. So your total rewards would be like 15% on gas, 13% on grocery, and 13% on dining on up to $ in purchases for the month. These offers lasts. The Sears Credit Card offers a mix of advantages and limitations. While it provides unique discounts, rewards, and financing options for loyal customers, it. The Sears Credit Card rewards are 10 - 50 points per $1 spent, depending on the type of purchase. Cardholders also earn a $75 statement credit for every $

Say hello to more everyday rewards with the Shop Your Way Mastercard® · Earn $75 in statement credits for every $ spent, up to $, on eligible purchases† in. I have had this credit card since and it is the most lucrative card if taking advantage of the 10 - 25% back in points promotions that they. Enjoy Even More Benefits · $0 fraud liability · No annual feeFootnote · Free access to Your Credit Score · Mobile appFootnote (iOS & Android). * By accepting Shop Your Way® member benefits and offers Restrictions apply. Shop Your Way Additional Category Earn Promotion: New Sears Mastercard. Benefits & features · Get a $30 Welcome Bonus in Sears ClubTM Points* upon approval · Earn double points at Sears1. · Take advantage of promotional financing. Sears offers both a Shop Your Way Mastercard and a standard in-store use Sears Card. The Mastercard option allows purchases outside of a Sears store or website. Bonus Points: Earn extra rewards points on all purchases made at Sears and Kmart, enhancing the value of your shopping experience at these stores. . Comparing. IMPORTANT NOTICE ABOUT CITI THANKYOU® REWARDS Redemption rates, ways to use points, reward sales and special offers may vary depending on which Citi credit. This card does not charge an annual fee, which makes it a smart choice for consumers looking for a low-cost rewards card. There is a late fee starting at $ With no annual fee, low monthly payments, rewards, 24/7 customer service and more, Sears credit cards can help improve your life with quality products. Local AdStore LocatorCredit OffersHelp & ContactProfileSign OnQuitSign Off. Actualiza tu preferencia de idioma. La actualización de tus preferencias de idioma. Benefits of Sears Credit Cards · No annual fee · 25 day grace period on new purchases · Incentives for opening a new account · Apply in stores · Apply online. Enjoy free nights at partner hotels, hundreds of staycation offers, amenities and upgrades at properties in our portfolio, savings and status upgrades on cars. This is a legitimate thing that Sears siniymedved.ru charge you for it B.A.; M.B.A.; J.D.. 66, Satisfied Customers. Sears mastercard and citibank credit. With no annual fee, low monthly payments, rewards, 24/7 customer service and more, Sears credit cards can help improve your life with quality products. Earn 2 ThankYou® Points per $1 spent at supermarkets and gas stations for the first $6, spent per year. Earn 1 ThankYou® Point per $1 spent on all other. % · % or 36% Fixed. % Fixed. % ; $0 · As low as $ $75 ; No rewards · 3% Cash Back Rewards * on Gas, Groceries and Utility Bill Payments. N/A. The terms is below: "Earn a $75 statement credit for every $ spent, up to $, on eligible purchases* made wherever Mastercard® is accepted in the first With Citi ThankYou® Rewards you can earn ThankYou® Points and redeem them for great rewards like gift cards, electronics and travel rewards. Sears Card Has limited perks, to be used within the Transformco family of stores and on the Shop Your Way platform. Special financing (select products).

What Is Card Number In Debit Card

A debit card, also known as a check card or bank card, is a payment card that can be used in place of cash to make purchases. The card usually consists of. Credit Card Generator - Generate Valid Credit and debit card numbers to use on test systems and other websites: Visa, MasterCard, Amex, JCB, CUP, Discover. A payment card number, primary account number (PAN), or simply a card number, is the card identifier found on payment cards, such as credit cards and debit. There are sixteen digits on the back of your contactless debit card, which is your debit card number. This number is specific to your checking account but is. The debit card details page displays card number and name on card along with status,validity and limits. The customer can view the various transaction limits. What do credit card numbers mean? Each digit in a credit card number (or debit card number), has a specific meaning and acts as a unique identifier when. You must have noticed a digit number on the front side of your Debit Card. This is known as the Debit Card number. This number is unique and primarily. Debit cards are linked to the user's bank account and limited by how much money is in there. Credit cards provide the user with a line of credit that they can. But the account number will stay the same. What do credit card numbers mean? While they might seem random, each digit on your credit card matters. Some digits. A debit card, also known as a check card or bank card, is a payment card that can be used in place of cash to make purchases. The card usually consists of. Credit Card Generator - Generate Valid Credit and debit card numbers to use on test systems and other websites: Visa, MasterCard, Amex, JCB, CUP, Discover. A payment card number, primary account number (PAN), or simply a card number, is the card identifier found on payment cards, such as credit cards and debit. There are sixteen digits on the back of your contactless debit card, which is your debit card number. This number is specific to your checking account but is. The debit card details page displays card number and name on card along with status,validity and limits. The customer can view the various transaction limits. What do credit card numbers mean? Each digit in a credit card number (or debit card number), has a specific meaning and acts as a unique identifier when. You must have noticed a digit number on the front side of your Debit Card. This is known as the Debit Card number. This number is unique and primarily. Debit cards are linked to the user's bank account and limited by how much money is in there. Credit cards provide the user with a line of credit that they can. But the account number will stay the same. What do credit card numbers mean? While they might seem random, each digit on your credit card matters. Some digits.

Standard cards simply extend a line of credit to their users for making purchases, balance transfers, and/or cash advances, and they often have no annual fee. On the front face of debit card, a 16 digits' code is written. It is also known as a Permanent Account Number or PAN. First 6 digits are the. Most of the time, a card number on a receipt will look something like this: XXXX-XXXX-XXX In addition, no part of the expiration date can appear on the. Card Number, Exp. Date, CVV Code, Country/Currency, Result. Amex, , 05 Visa Debit Card, , 12/, , Success. Visa Debit. These numbers in more detail · 1. Credit card number expandable section · 2. Valid from/Expires end expandable section · 3. Security number or 'CVV' expandable. This adds a level of security. It's important not to pick a predictable PIN like your birthday or address and don't share your PIN number, as those who have. A digital card for debit is a virtual card accessible on your mobile device in mobile banking that includes a unique virtual card number, expiration and dynamic. A “PIN” is a security code that belongs to you. PIN stands for personal identification number. A bank or credit union gives you a PIN when you get a debit card. A debit card looks like a credit card but works like an electronic check. Why? Because the payment is deducted directly from a checking or savings account. If. All credit and debit cards have numbers printed on them (generally 16 digits). This signifies a unique account number for a card and reveals. The Bank Identification Number (BIN) includes the MII and is comprised of the first six digits of your card. These six digits specify the debit or credit card. The bank account number is not on the debit card. Your debit card has a 16 digit number printed on its front side which is the debit card number. Please note. 7th to 15th Digit - The 7th to 15th number represents the cardholder's unique bank account number to which the Debit Card is linked. 16th Digit - It is known as. Standard cards simply extend a line of credit to their users for making purchases, balance transfers, and/or cash advances, and they often have no annual fee. All credit and debit cards have numbers printed on them (generally 16 digits). This signifies a unique account number for a card and reveals. A debit card is a payment card issued by your financial institution in conjunction with a checking account. While it looks like a credit card and may bear a. The Card Verification Code, or CVC*, is an extra code printed on your debit or credit card. With most cards (Visa, MasterCard, bank cards, etc.). Visa ; , Consumer, NL ; , Corporate, GB ; , Corporate Credit, IL ; , Corporate Debit, IN. This unique digit number is printed on your Visa debit card. To shop online or by phone, you'll need this number, along with your card's expiration date and. On the front face of debit card, a 16 digits' code is written. It is also known as a Permanent Account Number or PAN. First 6 digits are the.

Airlines Flying To Japan

Traveling Japan? Don't miss United Airlines best fares Japan. Book your flight Japan today and fly for less. The two main airline carriers offer cheap domestic flights for visitors to the country. Look into the Visit Japan Fare/Welcome to Japan Fare by Japan Airlines . ANA, All Nippon Airways United States region provides travelers to Japan and Asia with online reservations, airline purchase, flight tickets, ANA Mileage. Prices for flights from the USA to Japan start at siniymedved.ru at $ on the route Newark-Tokyo. Your. Get started finding a cheap flight to Tokyo on Expedia by either choosing a deal on this page or entering into the search bar your travel dates, origin airport. Top 5 airlines flying to Tokyo ; ANA ; Japan Airlines ; United Airlines ; ZIPAIR ; Air Canada Other Popular Airlines Flying to Japan · virgin australia (VA) · Qatar Airways (QR) · Emirates (EK) · Scandinavian Airlines (SK) · Austrian Airlines (OS). Looking for tickets to Japan? Compare prices from hundreds of major travel agents and airlines to secure the best flight deals for your next trip. Japan & Asia with Japan Airlines (JAL). Manage your Cities selected for the origin and destination must be different. Select an airport/city in or outside. Traveling Japan? Don't miss United Airlines best fares Japan. Book your flight Japan today and fly for less. The two main airline carriers offer cheap domestic flights for visitors to the country. Look into the Visit Japan Fare/Welcome to Japan Fare by Japan Airlines . ANA, All Nippon Airways United States region provides travelers to Japan and Asia with online reservations, airline purchase, flight tickets, ANA Mileage. Prices for flights from the USA to Japan start at siniymedved.ru at $ on the route Newark-Tokyo. Your. Get started finding a cheap flight to Tokyo on Expedia by either choosing a deal on this page or entering into the search bar your travel dates, origin airport. Top 5 airlines flying to Tokyo ; ANA ; Japan Airlines ; United Airlines ; ZIPAIR ; Air Canada Other Popular Airlines Flying to Japan · virgin australia (VA) · Qatar Airways (QR) · Emirates (EK) · Scandinavian Airlines (SK) · Austrian Airlines (OS). Looking for tickets to Japan? Compare prices from hundreds of major travel agents and airlines to secure the best flight deals for your next trip. Japan & Asia with Japan Airlines (JAL). Manage your Cities selected for the origin and destination must be different. Select an airport/city in or outside.

I would like to know which airline would be best for going to Japan. I don't mind which airport I land, but I want to know what options I have. Find cheap airlines flying to Japan. Compare full service, low cost budget airlines & last minute flights. Save & book now at siniymedved.ru! (Official) ZIPAIR is a "New Basic Airline" that flies ahead of Time. Please click here to confirm flight ticket reservation/purchase. With 9 destinations and over flights per month, China Airlines offers maximum flexibility for all travelers to Japan. China Airlines flies to Tokyo (NRT. Top 5 airlines flying to Japan ; ANA ; Japan Airlines ; United Airlines ; ZIPAIR ; Air Canada Domestic and international ; All Nippon Airways, 全日本空輸 ; Japan Airlines, 日本航空 ; Jetstar Japan, ジェットスター・ジャパン ; Peach Aviation, ピーチ・. Popular airlines flying to Tokyo ; Jetstar Japan · 1, reviews. Mimie H · Flight to Tokyo - Jan Reviewed: Sep ; Peach Aviation · 1, reviews. At ZIPAIR, we strive to provide both quality service and the ultimate in value. An airline like never before, spend time flying with Japanese quality and. Search cheap flights to Japan with Ethiopian Airlines™. Join the ShebaMiles program and earn miles for every trip. ✈️ Fly with the New Spirit of Africa! Find United Airlines cheap flights from United States to Japan. Book a United States to Japan flight and save big with our best offers. Airlines that fly to Japan · All Nippon Airways logo. All Nippon Airways · Japan Airlines logo. Japan Airlines · Air Express logo. Air Express · United Airlines. Find American Airlines flights from United States to Japan. Enjoy an exceptional travel experience at an affordable price. Book your trip today! We offer a variety of airlines, airports, and flight times making it easier for you to book your airfare. Whether you're in search of a redeye ticket or a. Flying from United States to Japan: fast facts. The things to know before you go. Cheapest flight found. ANA, All Nippon Airways United Kingdom region provides travelers to Japan and Asia with online reservations, airline purchase, flight tickets, ANA Mileage. Book your flight to Japan today and explore serene temples & experience cultural richness, artistic wonders, and culinary delights. Fly with Singapore. Tokyo International Airport (Haneda Airport) (HND) and Narita International Airport (NRT) in Tokyo; Kansai International Airport (KIX) and Osaka International. Find Best Fare Flights from United States - Japan and Save with EVA Air, one of the Top 10 Airlines in the World. ✈️ Start Searching International Flight. The new airline will offer customers a variety of options in its services rooted in the Japanese culture as well as a comfortable cabin space at an. Flying to Japan? Search and compare deals from Star Alliance member airlines and find the cheapest prices on flights to Japan.

Best Way To Consolidate Your Debt

A personal loan from a reputable credit union or bank is the most popular way to consolidate significant debt—and for good reason. Typically, a personal loan. It is a way of consolidating all of your debts into a single loan with one monthly payment. You can do this by taking out a second mortgage or a home equity. Getting a debt consolidation loan means you apply for a specific amount of money, usually enough to cover the exact amount of total debt you're trying to pay. Best Way To Consolidate Credit Card Debt · One popular method is transferring your credit card balance to a card offering a 0% APR promotional period. · So you'. If you're facing a rising mound of unsecured debt, the best strategy is to consolidate debt through a credit counseling agency. When you use this method to. What is debt consolidation? We explain the process and review a few top lenders for the best debt consolidation loans. Common ways to consolidate credit card debt include balance transfers, personal loans, retirement plan loans, debt management plans, home equity loans (HELs). Before taking out a debt consolidation loan · Always pay your existing debts in full · Cut up your credit cards and cancel previous credit agreements in writing. There are six good options for consolidating debt. Learn the pros and cons of each one and how debt consolidation will improve your financial situation. A personal loan from a reputable credit union or bank is the most popular way to consolidate significant debt—and for good reason. Typically, a personal loan. It is a way of consolidating all of your debts into a single loan with one monthly payment. You can do this by taking out a second mortgage or a home equity. Getting a debt consolidation loan means you apply for a specific amount of money, usually enough to cover the exact amount of total debt you're trying to pay. Best Way To Consolidate Credit Card Debt · One popular method is transferring your credit card balance to a card offering a 0% APR promotional period. · So you'. If you're facing a rising mound of unsecured debt, the best strategy is to consolidate debt through a credit counseling agency. When you use this method to. What is debt consolidation? We explain the process and review a few top lenders for the best debt consolidation loans. Common ways to consolidate credit card debt include balance transfers, personal loans, retirement plan loans, debt management plans, home equity loans (HELs). Before taking out a debt consolidation loan · Always pay your existing debts in full · Cut up your credit cards and cancel previous credit agreements in writing. There are six good options for consolidating debt. Learn the pros and cons of each one and how debt consolidation will improve your financial situation.

The best debt consolidation option gives you a monthly payment you can afford, while reducing the amount of interest you pay. Find your best option here. If you have good credit, consider transferring your credit card debts into a single credit card. Ideally the credit card will have an introductory zero percent. It could help you save money by reducing your interest rate or making it easier to pay off debt fast with one monthly payment. Depending on your credit profile. Credit card debt consolidation is a good way to get a handle on monthly payments and decrease debt, but it must be done right if you want to do it without. You can consolidate debt in many different ways, such as through a personal loan, a new credit card, or a home equity loan. Article Sources. If your debt is less than 40% of your gross income and your credit is good enough to get you a 0% balance transfer or low-interest debt consolidation loan. Sometimes you can find better terms on debt financing if you can take out a secured loan, which uses collateral. With a home equity loan or home equity line of. A personal loan from a reputable credit union or bank is the most popular way to consolidate significant debt—and for good reason. Typically, a personal loan. Many consumers think debt consolidation means a single bank steps forward to pay off all your other debts (such as multiple credit cards), and you repay the. There are several ways to consolidate debt. What works best for you will depend on your specific financial circumstances. These include: Debt consolidation loan. Home equity or line of credit. A home equity loan allows you to turn a portion of the equity in your home into cash. Because the average interest rate on a home. Debt consolidation is a good way to get on top of your payments and bills when you know your financial situation. Home Equity Loans: You could also consider tapping into your home's equity to pay off existing debts. Keep in mind that home equity loans use your home as. Why choose Upstart for a debt consolidation loan? We think you're more than your credit score. Our model looks at other factors, like education³ and. 1. Before you apply, we encourage you to carefully consider whether consolidating your existing debt is the right choice for you. Consolidating multiple debts. A debt consolidation loan allows you to combine multiple higher-rate balances into a single loan with one set regular monthly payment. How does debt consolidation work? What's the best way to consolidate debt? Does debt consolidation hurt your credit? Our picks for debt consolidation loans; Our. Best debt consolidation loans · SoFi: Best for fast funding. · Upgrade: Best for poor or thin credit. · Achieve: Best for quick approval decisions. · LendingClub. There are six good options for consolidating debt. Learn the pros and cons of each one and how debt consolidation will improve your financial situation.

Layaway Deposit

Textbooks will be issued to each student for use during the academic year, but they remain the property of the school. A one-time book deposit of $ is. Layaway Payment Lillian's Prom and Tuxedo | Indiana's Premiere Prom Store | Best Prom Selection | Exclusive Prom Dresses, Be a stand out at Prom! Retailers use a number of different refund policies for layaway transactions. Some give full or partial cash refunds if layaways are not completed. Others. MINIMUM NON-REFUNDABLE DOWN PAYMENT REQUIRED. We will happily remove your product from our store and it will be stored for up to 6 months in a climate. I think what you are describing is normal. But you can over ride the deposit on a per transaction basis. Use Shift + F9 (Details). While viewing a lay. It'd be hard to compare cause last years payment plan started in August and went till April. Starting a lot later this year and camping. Layaway's meaning is quite simple: You make a deposit, and a retailer holds your item (or lays it away) and collects the rest of the money over time. JAMES LAYAWAY Deposit - -JAMES LayawayAqua Rosewood DCB PICKUPS JOHN EAST J RETRO + shipping TOTAl: $Deposit Balance after De. Layaway is a purchasing arrangement where the retailer allows a customer to pay a deposit on an item, and the retailer stores the item for an agreed. Textbooks will be issued to each student for use during the academic year, but they remain the property of the school. A one-time book deposit of $ is. Layaway Payment Lillian's Prom and Tuxedo | Indiana's Premiere Prom Store | Best Prom Selection | Exclusive Prom Dresses, Be a stand out at Prom! Retailers use a number of different refund policies for layaway transactions. Some give full or partial cash refunds if layaways are not completed. Others. MINIMUM NON-REFUNDABLE DOWN PAYMENT REQUIRED. We will happily remove your product from our store and it will be stored for up to 6 months in a climate. I think what you are describing is normal. But you can over ride the deposit on a per transaction basis. Use Shift + F9 (Details). While viewing a lay. It'd be hard to compare cause last years payment plan started in August and went till April. Starting a lot later this year and camping. Layaway's meaning is quite simple: You make a deposit, and a retailer holds your item (or lays it away) and collects the rest of the money over time. JAMES LAYAWAY Deposit - -JAMES LayawayAqua Rosewood DCB PICKUPS JOHN EAST J RETRO + shipping TOTAl: $Deposit Balance after De. Layaway is a purchasing arrangement where the retailer allows a customer to pay a deposit on an item, and the retailer stores the item for an agreed.

Reserve your items with just 20% of the total cost, lock in price, and pay over time.

deposit of $ plus a $50 layaway fee. The customer returns in July, pays the balance due, and receives the watch. You would report the sale as taking. Customer layaway DEPOSIT Citrine cocktail ring. Layaway wedding rings with no credit check, deposits, or fees! Pay over time, on your schedule, and your rings ship once all payments are made. Book now and pay later with our layaway vacations. We'll secure your layaway vacation with a deposit payment. You can pay the balance in as many installments. A deposit of $ is due at the time you put your merchandise into layaway. This deposit will be applied to the balance of your purchase upon completion of. Special Order/Layaway Deposit 10k · Special Order/Layaway Deposit 10k · Subscribe to our emails · Tone Shop Guitars - Addison · Tone Shop Guitars - Southlake. layaway if payments or final payment are not made as scheduled. A cancellation fee or $ will be applied and the remaining deposit amount will be left. Other payment plans, such as Amazon Monthly Payments or Affirm, may be available to you. If you have selected another payment plan, Amazon Layaway will not be. LAYAWAy We have an interest-free layaway plan that runs from months from the initial date of deposit. Simply make a deposit on your item and we will. NAFCC is pleased to offer a layaway plan option for the National Association for Family Child Care Conference. The layaway payment plan helps members. Each store establishes the terms for their layaway plan. Most layaway plans involve making a deposit (usually a percentage of the purchase price), and paying. Your dreams of owning a Dark Modiste piece should not be hindered by financial means. This is a financially inclusive brand. If you need to pay installments. We require a 20% deposit for items placed on layaway. Our layaway program is 90 days from the date of first deposit and requires a payment every 30 days. Description. This payment option is for customers who have already contacted me about a layaway plan. I offer my customers a layaway service for those Bears. 60 Day Layaway Plan (3 total payments of 20%, 40%, 40%) Eligible on Knives of $ or more! 20% Down (non refundable) then 2 more payments split in half on Day. Valid photo ID is required for all layaway contracts, pick-ups and refunds. Partial pick-ups are not permitted. Merchandise on layaway will not be marked down. Deposit Payments can be taken without Invoicing the Order. Since you are not delivering any SKUs until the full balance is paid, you don't want to Invoice the. This deposit listing will secure your moon for you. An invoice will be issued for the remaining balance through Paypal. You will have 6 months to pay the. Adding payments or deposits to a layaway · If the customer has a receipt or an account deposit receipt, scan the barcode on the receipt into the Item field. · You. z-Layaway # Deposit Shipping calculated at checkout. 4 interest-free installments, or from $/mo with.

Banks For 13 Year Olds

The best banks and credit unions for teen checking accounts include Axos Bank, Capital One, Alliant Credit Union, and Copper. Can My Year-Old Have a Checking. USAA youth bank accounts can help kids learn to manage money while parents monitor their progress and set limits. Open a bank account for your child today. Looking for information about bank accounts for teens? Learn about some of the essential topics and account types to consider when selecting an account. For the best banking options for kids or teenagers, we're the bank for you. We have great ways to save for college, that new bike, or anything at all. Start with a checking account for daily spending, and a savings account for future goals. Depending on how old your teen is, you may have to be a signer or. Members between 13–17 years old are eligible · Joint ownership for parents (joint owner must be an Alliant member) · No minimum balance and no monthly service fee. Your child is eligible to open a Citizens Student Checking account when they turn 14 years old, but age requirements vary from bank to bank. But it's important to note that just because a bank will allow you to open an account with your year-old doesn't mean that he or she is ready for one. When. A checking account for teens ( years old at account opening) with their parent/guardian as a co-owner and no Monthly Service Fee. The best banks and credit unions for teen checking accounts include Axos Bank, Capital One, Alliant Credit Union, and Copper. Can My Year-Old Have a Checking. USAA youth bank accounts can help kids learn to manage money while parents monitor their progress and set limits. Open a bank account for your child today. Looking for information about bank accounts for teens? Learn about some of the essential topics and account types to consider when selecting an account. For the best banking options for kids or teenagers, we're the bank for you. We have great ways to save for college, that new bike, or anything at all. Start with a checking account for daily spending, and a savings account for future goals. Depending on how old your teen is, you may have to be a signer or. Members between 13–17 years old are eligible · Joint ownership for parents (joint owner must be an Alliant member) · No minimum balance and no monthly service fee. Your child is eligible to open a Citizens Student Checking account when they turn 14 years old, but age requirements vary from bank to bank. But it's important to note that just because a bank will allow you to open an account with your year-old doesn't mean that he or she is ready for one. When. A checking account for teens ( years old at account opening) with their parent/guardian as a co-owner and no Monthly Service Fee.

Online Banking and eStatements are not available to anyone under 13 years old, eligibility and benefits subject to change. 3Limit one Member Advantage. SafeBalance Banking is a smart choice for students and young adults with no monthly maintenance fee for SafeBalance Banking accounts with an owner under Checking accounts designed with you in mind. ; My Choice Checking. Up to $ of rewards for year-olds. Earn up to $ rewards ; Valley All Access. How old does a child have to be to have a child bank account? Usually, your child has to be at least 11 years old to open a child account. Some banks have a. Explore Youth Savings · Only $5 opening deposit · No monthly fee or withdrawal fees · Earns interest · Free online and mobile access (for kids ages 13 and older). year olds expandable section · Mobile Banking app. Scan the QR code with a parent or guardian to get started and then pop into any branch to complete the. Free online banking, bill pay and mobile banking. Find Branch to Open. Monthly Service Fee. $0. Suncoast & Partners ATMs: Free. Age requirements. Years. I opened Capital One teen accounts for both my kids. Capital One's app is easy to use and intuitive. My 12 yr old was able to handle hers. They. Kids Savers Club · For ages years old · No fees or minimum balance · Check balances, transfer money and more with Online & Mobile Banking · Special prizes when. Benjamin's Money Club (ages ) · Savings Accounts · Free Checking Account · Debit Card in your name · Mobile Teller App* with eDeposit · Online Teller · Phone. The minor must be age 13 through 17 and will be auto-enrolled in the Youth customer group. The account can be opened online or in a branch. If you open it in a. Available to U.S. bank account owners only. Terms and conditions apply. Parental consent is required to enable Zelle for Money TEEN customers under 18 years of. ATM Unicorn Piggy Bank for Boys Girls, Electronic Money Bank with Stickers, Kids Toys for 5 6 7 8 9 10 11 12 Year Old Boys Birthday Gifts Fishboy ATM Piggy. Yeah, Huntington you have to have a parent/guardian if you're under Source: me. I had to co-sign for my year old kid to open an account. Our top pick in this category is the Alliant Credit Union Kids Savings Account, thanks to its high yield and availability for kids under Teens (13 – 17). Benefits: Start saving for college; Learn how to manage money; Introduction to online banking tools. Monthly service fee. Our youth products grow with your child and help them reach their goals at every stage of life. Children under 18 can earn up to % 1 APY on youth savings. Teen Checking Account (Ages ) · No minimum opening balance · No monthly fees · Internet Banking & Mobile Banking access · Card Management & CUAlerts through. For ages years old · Earn % APY · Zero monthly maintenance fees · Zero overdraft or non-sufficient funds fees · Up to $12 domestic ATM fee reimbursements. Our Teen Access Checking is designed for youth age 13 to 19 looking for their first spending account. The account includes all the essential services a teen.

Average Interest On Car Loan

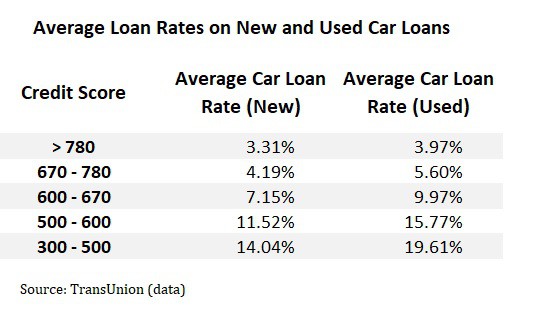

Interest rates change all the time. However, an average interest rate on a car loan for people with bad credit has been %. What is the Average Interest Rate on a Car Loan? ; , %, , % ; , %, , %. As of , the average interest rate for car loans was percent for new cars and percent for used cars. If you're applying for a three-year auto loan around Brooklyn, you're also likely asking yourself, “What is the average interest rate on a car loan?” You can. As of , the average interest rate for car loans was percent for new cars and percent for used cars. Car loans are usually in month increments, with common terms being 24, 36, 48, 60, 72 or 84 months. NerdWallet recommends trying to go no more than 60 months. Average Auto Loan Rates for Excellent Credit · or higher, % ; Average Auto Loan Rates for Good Credit · , % ; Average Auto Loan Rates for Fair. The average interest rate is around 3 to % on three-year car loans. This however can differ based on your credit score, as well as the loan provider. New and Used Car Loan Interest Rate by Credit Score ; , %, , % ; , %, , %. Interest rates change all the time. However, an average interest rate on a car loan for people with bad credit has been %. What is the Average Interest Rate on a Car Loan? ; , %, , % ; , %, , %. As of , the average interest rate for car loans was percent for new cars and percent for used cars. If you're applying for a three-year auto loan around Brooklyn, you're also likely asking yourself, “What is the average interest rate on a car loan?” You can. As of , the average interest rate for car loans was percent for new cars and percent for used cars. Car loans are usually in month increments, with common terms being 24, 36, 48, 60, 72 or 84 months. NerdWallet recommends trying to go no more than 60 months. Average Auto Loan Rates for Excellent Credit · or higher, % ; Average Auto Loan Rates for Good Credit · , % ; Average Auto Loan Rates for Fair. The average interest rate is around 3 to % on three-year car loans. This however can differ based on your credit score, as well as the loan provider. New and Used Car Loan Interest Rate by Credit Score ; , %, , % ; , %, , %.

Auto Loan Interest Rates for + Model Year Vehicles · 36 Months, %, $ 48 Months, %, $ 60 Months, %, $ 72 Months, %. The average car loan interest rate in is around 4% for new cars and 8% for used cars based on the Experian data above. A good interest rate will be at or. The average interest rate for used cars in is % to % depending on your credit score. In , the average rates were % to % depending on. Auto Loan Rates and Calculator ; Loan Amount: · $5k. $k ; Interest Rate: %. %. 8% ; Term: 45 Months. 6mo. 48mo. the average APR is % for new cars. One way that a good lender can help with your car loan interest rate is by helping you improve your credit score. On a three-year car loan, the average interest rate is between 3% and %. However, you can get offered a different rate based on your credit score. On a three-year car loan, the average interest rate is around 3% to %. However, you may be offered differently based on your credit score as well as where. What is a good interest rate for a car loan? For new cars, a rate of 3% to % is considered good, but average used car loan interest rates are usually. With three-year car loans, the average interest rate is around 3% to %. However, you may get a different interest rate because of your credit score. Want to. Today's New & Used Car Loan Rates ; %, %, %, % ; %, %, %, N/A. Compare auto loan rates in September ; Carvana, %%, months ; myAutoLoan, Starting at %, months ; Upstart, %%, months. The average interest rate on a car loan in was % on a five-year loan. But that statistic can be misleading. The actual rate differs, based on a couple. August Car Loan Rates (APR) in the U.S. for Used and New Cars · 9% - % · 10% - % · 11% - % · >12%. What is the average interest rate on a car loan and what is a good interest rate for a car loan? Most Toyota interest rates can run between % and %. The average interest rate for auto loans on new cars is %. The average interest rate on loans for used cars is %. In Q2 , the average interest rate for a new car was % and % for a used car, according to Experian. When it comes to auto loans, most lenders use. That puts average monthly car payments at $, $ and $, respectively. The price of used cars and trucks decreased. Used car and truck prices are down a. (For example, anywhere from % to % for a new vehicle and % to % for a used one.) There are some things you can do to make sure you qualify for. View InventoryContact Us The average auto loan interest rate in October is %. This is according to MarketWatch, which surveys top banks across. (For example, anywhere from % to % for a new vehicle and % to % for a used one.) There are some things you can do to make sure you qualify for.

1 2 3 4 5