siniymedved.ru Market

Market

100 Equity Refinance

With this loan, you can borrow up to % of your home's value, minus your mortgage balance. That means you'll have the resources you need when you need them. Fixed rate loans for up to 20 years with up to % loan-to-value (LTV). ADDITIONAL HELOC & HOME EQUITY BENEFITS & FEATURES. Low closing costs; No annual fee. A % loan-to-value (LTV) home equity loan is particularly noteworthy as it allows you to borrow against the entire value of your equity. For example, if your. We've combined the flexibility of a home equity line of credit (HELOC) with the control of a home equity loan. You have the ability to borrow up to % of. Fixed rate loans for up to 20 years with up to % loan-to-value (LTV). ADDITIONAL HELOC & HOME EQUITY BENEFITS & FEATURES. Low closing costs; No annual fee. Borrow up to percent on your home equity loan or HELOC. Most lenders only let you borrow 60 to 80 percent of your home's equity. Rocket Mortgage allows borrowers to take out a home equity loan on a second property, though they don't offer e-closing. We can help you borrow up to % of your home's value. Get started now! Home equity loans are available in Pennsylvania and Maryland only. No closing costs · Borrow up to % of your home's equity · Min/max loan amount: $10, - $, · Fixed rate for the life of the loan · No application or. With this loan, you can borrow up to % of your home's value, minus your mortgage balance. That means you'll have the resources you need when you need them. Fixed rate loans for up to 20 years with up to % loan-to-value (LTV). ADDITIONAL HELOC & HOME EQUITY BENEFITS & FEATURES. Low closing costs; No annual fee. A % loan-to-value (LTV) home equity loan is particularly noteworthy as it allows you to borrow against the entire value of your equity. For example, if your. We've combined the flexibility of a home equity line of credit (HELOC) with the control of a home equity loan. You have the ability to borrow up to % of. Fixed rate loans for up to 20 years with up to % loan-to-value (LTV). ADDITIONAL HELOC & HOME EQUITY BENEFITS & FEATURES. Low closing costs; No annual fee. Borrow up to percent on your home equity loan or HELOC. Most lenders only let you borrow 60 to 80 percent of your home's equity. Rocket Mortgage allows borrowers to take out a home equity loan on a second property, though they don't offer e-closing. We can help you borrow up to % of your home's value. Get started now! Home equity loans are available in Pennsylvania and Maryland only. No closing costs · Borrow up to % of your home's equity · Min/max loan amount: $10, - $, · Fixed rate for the life of the loan · No application or.

Home Equity Line of Credit (HELOC) · Loan amounts from $10, to $, · Borrow up to % of your homes' equity · Low variable rates starting as low as prime. ($ minimum required). Your account will also have an updated term of 30 years (year draw period and year repayment period) and your existing line of. With a home equity loan, you can borrow 80% to % of your home's value, minus what you owe on your mortgage. You receive one lump sum with a fixed rate. With a HELOC, you can borrow up to %* of the available equity on your primary residence as long as your mortgage balance is less than your home's value. Cash-Out Refinancing replaces your current mortgage with a new one. This mortgage is for an amount larger than what you currently owe. % online application. No in-person appraisal needed. Get approved in with a HELOC vs a Cash-Out Refinance Opens in a new window. See how much you. Borrow up to % of your home's equity at FIGFCU. Get cash for home upgrades and remodels, consolidate debt, or make large purchases. Note, on certain refinance transactions we may lend up to % of the total equity in your home. Please contact a Home Equity Specialist at for. You can borrow 80% of your home's value at a low rate or borrow up to % of the value at a slightly higher rate. Our home equity loans have fixed interest. Loan amount may be less than % of your home's combined loan-to-value. 2,3 All loans are subject to approval. All applicants must meet underwriting criteria. Compare rates and payments below. Financing up to % combined loan to value on all home equity loans available. Loan Restrictions. Most lenders won't allow you to borrow % of the equity in your home for a home equity loan. While you may qualify to borrow up to A 7 17 Credit Union Home Equity Loan or Line of Credit (HELOC) can help you use the equity of your Ohio home to finance large expenses Finance up to % of. No closing costs · Borrow up to % of your home's equity · Min/Max loan amount: $10, - $, · Fixed rate for the life of the loan · No application or. The equity in your home can be a powerful financial tool. Finance up to % of your home's value, less what you owe with a home equity loan at Fibre. Home Equity Loan · One low fixed rate over the life of the loan · Get the full amount borrowed in one lump sum · Payments do not change · Up to % financing · No. Borrow up to % of your home's value minus your mortgage balance. Competitive fixed interest rates · No annual fees or transaction fees · Interest may be tax deductible — consult a tax advisor to confirm · Up to % loan-to-. But some lenders offer high-LTV home equity loans with LTVs of up to % if you're willing to accept a higher rate. How do I calculate my home equity loan. Principal and interest payments on the outstanding balance; Borrow up to % of available equity; Draw funds, pay off the balance, use again, or keep the line.

Should I Take Money Out Of My 401k

You won't pay taxes and penalties on the amount you borrow, as long as the loan is repaid on time · Interest rates on (k) plan loans must be consistent with. What to know before taking funds from a retirement plan · Immediate and costly tax penalty. Dipping into a (k) or (b) before age 59 ½ usually results in a. The only exception when it would make sense to withdraw early from your (k) during this penalty-free period would be if you absolutely needed the funds for. Despite these benefits, borrowing against a (k) is a risky proposition. There are harsh penalties for failure to repay and taking money away from retirement. 1. Before You Take a Lump Sum, Consider Whether You Have an Extreme & Immediate Need for Cash If you withdraw cash from your (k), it's possible you could. Overall, you should only take on a loan from your (k) if you have exhausted all other funding options because taking money out of your (k) means you. Many (k) plans allow you to withdraw money before you actually retire to pay for certain events that cause you a financial hardship. But taking money out of your retirement savings account early, no matter the circumstance, could be a costly mistake. There are no penalty exemptions for the. Just because you can, doesn't mean you should. Remember, if you're taking money from your retirement account, it can no longer benefit from (potential). You won't pay taxes and penalties on the amount you borrow, as long as the loan is repaid on time · Interest rates on (k) plan loans must be consistent with. What to know before taking funds from a retirement plan · Immediate and costly tax penalty. Dipping into a (k) or (b) before age 59 ½ usually results in a. The only exception when it would make sense to withdraw early from your (k) during this penalty-free period would be if you absolutely needed the funds for. Despite these benefits, borrowing against a (k) is a risky proposition. There are harsh penalties for failure to repay and taking money away from retirement. 1. Before You Take a Lump Sum, Consider Whether You Have an Extreme & Immediate Need for Cash If you withdraw cash from your (k), it's possible you could. Overall, you should only take on a loan from your (k) if you have exhausted all other funding options because taking money out of your (k) means you. Many (k) plans allow you to withdraw money before you actually retire to pay for certain events that cause you a financial hardship. But taking money out of your retirement savings account early, no matter the circumstance, could be a costly mistake. There are no penalty exemptions for the. Just because you can, doesn't mean you should. Remember, if you're taking money from your retirement account, it can no longer benefit from (potential).

Overall, when possible, you should not withdraw funds from your (k) until you reach retirement age. Even then, you should consider leaving the funds in your. Bottom line: it's unwise to take money out of a k before retirement. You are throwing money away and hurting your retirement prospects. You'. In general, it is not advisable to withdraw money early from your K. However, in some cases, especially financial hardship or early retirement, an early. Be aware that there could be tax and penalty implications. If you take money out of your CalSavers Roth IRA and you don't meet the criteria for a qualified. Investors in a (k) plan must wait until retirement before taking distributions or withdrawals from the account. Taking funds out before 59½ incurs a 10%. Use this calculator to estimate how much in taxes and penalties you could owe if you withdraw cash early from your (k). Money cannot stay in a retirement plan account forever. In most cases, you are required to take minimum distributions or withdrawals from your k, IRA. These plans use IRAs to hold participants' retirement savings. You can withdraw money from your IRA at any time. However, a 10% additional tax generally applies. You can take money from your (k) account if you are age 59½ or older. You will not have a penalty. Twenty percent is withheld for federal income taxes. You. It's not ideal to pull from these funds early, however. Your workplace retirement plan should be among the last places you look for money in a pinch. Can I Withdraw From My k Early? · The IRS levies a 10% penalty on all non-exempt withdrawals before the age of 59 ½. · Since pre-taxed money funded your k. While taking money out of your (k) plan is possible, it can impact your savings progress and long-term retirement goals so it's important to carefully weigh. If you have to withdraw money from your account, another option to avoid the penalty is to take out a (k) loan. Although the loan must be repaid within five. The 4% rule is a strategy that says you should withdraw 4% of your retirement savings in your first year of retirement. The second year, you would take out. If it's at all possible to avoid taking money from your (k) before you're retired, you should generally try to do so. You could spend two, or even three. If you're taking out funds from your retirement account prior to age 59½ and exceptions apply, use IRS Form to report the amount of 10% additional tax you. If your (k) or (b) balance has less than $1, vested in it when you leave, your former employer can cash out your account or roll it into an individual. Why You Should Withdraw Money With a traditional IRA, you cannot sit on that nice nest egg you've been building. You must begin making distributions from your. The main benefit of a (k) is that you can defer taxes when you are in your main earning years, and likely in a higher tax bracket, then. Learn how you may avoid the 10% early withdrawal penalty when taking money from your retirement account.

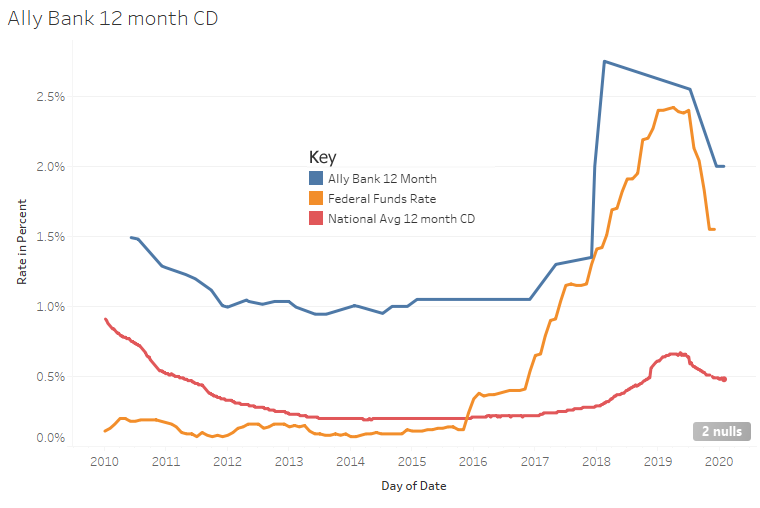

What Are The Cd Rates At Ally Bank

Ally Bank's IRA High Yield CD offers a fixed rate among our highest available for growing your retirement savings. Ally Bank, Member FDIC. Founded in , EverBank, formerly known as TIAA Bank, is a Jacksonville, Florida-based bank offering CDs, high-yield savings accounts, checking accounts, and. The Ally Bank No-Penalty CD earns % APY and allows you to withdraw your full balance, including interest earned—at any time after the first six days from. Ally Bank Savings Account interest rates fare well compared to other financial institutions. Its savings account earns an APY of % APY on all balances. Ally Bank has one of the most popular savings accounts on the market, thanks to its high interest rates, its buckets feature, and more. Ally Bank ; 18 Mo. 18 Mo, % ; 36 Mo. 36 Mo, % ; 60 Mo. 60 Mo, % ; 24 Mo Raise Your Rate 1x. 24 Mo Raise Your Rate 1x, %. Ally Bank's current CD rates range from % to % APY, depending on the CD and chosen term. However, if you have a particularly large deposit, you may. Ally Bank does offer both a high-yield savings account and high-yield CDs, but it does not offer 7% interest. This rate is not something banks currently offer. Ally Bank CD rates are competitive, and there is no minimum deposit required to open. Several term options, as well as a special no-penalty CD. Ally Bank's IRA High Yield CD offers a fixed rate among our highest available for growing your retirement savings. Ally Bank, Member FDIC. Founded in , EverBank, formerly known as TIAA Bank, is a Jacksonville, Florida-based bank offering CDs, high-yield savings accounts, checking accounts, and. The Ally Bank No-Penalty CD earns % APY and allows you to withdraw your full balance, including interest earned—at any time after the first six days from. Ally Bank Savings Account interest rates fare well compared to other financial institutions. Its savings account earns an APY of % APY on all balances. Ally Bank has one of the most popular savings accounts on the market, thanks to its high interest rates, its buckets feature, and more. Ally Bank ; 18 Mo. 18 Mo, % ; 36 Mo. 36 Mo, % ; 60 Mo. 60 Mo, % ; 24 Mo Raise Your Rate 1x. 24 Mo Raise Your Rate 1x, %. Ally Bank's current CD rates range from % to % APY, depending on the CD and chosen term. However, if you have a particularly large deposit, you may. Ally Bank does offer both a high-yield savings account and high-yield CDs, but it does not offer 7% interest. This rate is not something banks currently offer. Ally Bank CD rates are competitive, and there is no minimum deposit required to open. Several term options, as well as a special no-penalty CD.

Ally has a selection of three CDs. The high-yield CD comes in terms from three months to five years and pays an APY of %. The month No Penalty CD has an. Ally Bank® CDs · Annual Percentage Yield (APY). From % to % APY · Terms. From 3 months to 5 years · Minimum balance. None · Monthly fee. None · Early. Ally Bank: % APY for month CD. No minimum to open. CIT Bank: % APY for month CD. $1, minimum to. The CD rates for this account have an APY of% (APY stands for annual percentage yield, rates may change). This is higher than the typical APY for online-. High Yield CD ; Ally Bank, 1 year, % APY ; Ally Bank, 18 months, % APY ; Ally Bank, 2 years, % APY ; Ally Bank, 3 years, % APY. Ally savings account interest rate. As of September , the Ally Bank APY is %. Interest is credited to your account once per month as a total earned. Founded in , EverBank, formerly known as TIAA Bank, is a Jacksonville, Florida-based bank offering CDs, high-yield savings accounts, checking accounts, and. Compare our savings, CD, money market, checking and IRA rates and features all in one place. Straightforward with no hidden fees. Ally Bank Member FDIC. Ally Bank's rate for a 3 month certificate of deposit (CD) at $10, beats the National average by up to % and is eligible for a Datatrac Great Rate Award. Best CD Rate and Service. 06/20/24 | null recommended this product. Verified Account Owner. I have several CDs with Ally and all my interactions with Ally. Ally High Yield CD Rates ; 9-Month, All balances: % APY ; Month, All balances: % APY ; Month, All balances: % APY ; 3-Year, All balances: %. If the current rate we offer for your term and balance tier is higher than your interest rate and you're eligible for a rate increase, you can raise your rate. The month CD at % APY has 60 days interest for early withdrawal. Assuming a $ deposit, here is my calculation (which could be wrong). 2 interest rate decreases in a few months and 3 total in under a year. There are many other banks that still honor and provide close to or at a 2% interest rate. View a side-by-side comparison of our Ally Bank IRA accounts. Start by choosing the account type that best suits your situation. When you fund your CD on the same day you open it or on one of the next 9 calendar days, you'll get the best rate we offer for your term and balance if our rate. Ally Bank savings account interest rates. Ally offers the same interest rate regardless of your balance. The high-yield savings account has no minimum deposit. High Yield and No Penalty CDs: These qualify for our Ten Day Best Rate Guarantee. When you fund your CD within 10 days of your opening date, you'll get the. With our No Penalty CD, you'll get a fixed interest rate with no early withdrawal penalty following 6 days after the date of funding. Ally Bank Member FDIC. Ally Bank CD Rates. Ally Bank CD rates. Rate History for Ally Bank - 5 Year CD. Best CD Rates and Savings Rates.

First Credit Card To Build Credit Score

Learn how to get your first credit account and build a credit history that is reported on a credit report. Credit can help you get a loan, credit card, job. Check your credit report Now that you're actively building credit via your first credit card, it's important to get into the habit of monitoring it. Three. When handled responsibly, a credit card can help you build your credit history, which could be helpful when looking for an apartment, a car loan, and even a job. Stay informed. You need to know what's on your credit report and how it's affecting your score. · Options like a secured credit card or piggybacking are great. When managed responsibly, your credit card can help build and improve your credit score, making it easier to get approval to borrow money for bigger purchases. Whether you're establishing credit for the first time or working to repair your credit, our credit builder card may be right for you. Learn more. Know how to choose the right first credit card for you with guidance on the best ways to start building your credit history. Chase Freedom Rise℠ is the best credit card to build credit because it offers automatic credit line reviews, no annual fee and unlimited cash rewards. First Latitude Select Mastercard® Secured Credit Card No minimum credit score required for approval! **Cardholders who keep their balance low and pay their. Learn how to get your first credit account and build a credit history that is reported on a credit report. Credit can help you get a loan, credit card, job. Check your credit report Now that you're actively building credit via your first credit card, it's important to get into the habit of monitoring it. Three. When handled responsibly, a credit card can help you build your credit history, which could be helpful when looking for an apartment, a car loan, and even a job. Stay informed. You need to know what's on your credit report and how it's affecting your score. · Options like a secured credit card or piggybacking are great. When managed responsibly, your credit card can help build and improve your credit score, making it easier to get approval to borrow money for bigger purchases. Whether you're establishing credit for the first time or working to repair your credit, our credit builder card may be right for you. Learn more. Know how to choose the right first credit card for you with guidance on the best ways to start building your credit history. Chase Freedom Rise℠ is the best credit card to build credit because it offers automatic credit line reviews, no annual fee and unlimited cash rewards. First Latitude Select Mastercard® Secured Credit Card No minimum credit score required for approval! **Cardholders who keep their balance low and pay their.

The Capital One Platinum Credit Card is a decent option to help build your credit score responsibly. It has no annual fee or foreign transaction fees, and. Failing to do so for either type of card could result in damage to your credit scores. However, unsecured credit cards are often harder to qualify for than. For many people, building credit starts by making timely payments on a student loan or credit card. However, to qualify for a credit card or loan in the first. You need to start with a credit card from Discover bank or Capital One siniymedved.ru because they have easier approvals for people that are just starting out. The best starter credit cards are easy to get, have no annual fee and report your payments to the three major credit bureaus. A good place to start is by opening a credit card at 18, so you can start building credit at an early age and developing good money habits. With some solid first steps and a focus on paying your bills on time, you'll be on your way to building a solid credit score. Applying for a beginner card, like a secured credit card or student credit card, might be a good way to start your credit journey. See if you're pre-approved. Apply for the BankAmericard® secured credit card to start building your credit and enjoy access to your FICO® Score updated monthly for free. Credit builder cards are a type of credit card that can be used to improve your credit score. When you use a credit builder card you'll do exactly that: build . How to build credit with your first credit card. When you begin using your new credit card, you'll want to demonstrate responsible credit management over time. This can also be useful for you down the road, since you can establish a relationship with Chase, and Chase has some of the best rewards cards on the. Yes, any credit line or type of credit card can help you build credit history by influencing the factors that affect your credit score. But you're responsible. Citi® Secured Mastercard®: This card lets you track your progress as you build credit with access to a free FICO score. · Discover it® Secured Credit Card: You. Create a plan · Contact all creditors. · Pay off delinquent accounts first, then debts with higher interest rates; you may save money · Consider a debt. But while you can't speed up time and jump-start your average credit age, you can set yourself up for success by applying for a good starter credit card at age. The Capital One Platinum Credit Card is a decent option to help build your credit score responsibly. It has no annual fee or foreign transaction fees, and. But most of all, opening a credit card could help establish good credit. Your credit will be checked most likely, and your credit score will be based on things. The best type of credit card to start with is a secured credit card. Secured cards are perfect for beginners because they're the easiest cards to get, as they. Paying your credit card bills or other loan payments on time is one critical step in building a good credit score. Also, don't get too close to the credit limit.

Bingo Tokens

60 PCS Bingo Paper Game Cards: Home Bingo Game Set with *, Reusable Number Cards Paper, Suitable for Birthday Parties and Company Events. The most chips one can place on a bingo board without having a bingo is 19, not counting the free space. (For this to happen, two spots in opposite corners. Pcs of 3/4 inch Transparent 8 Color Bingo Counting Chips Plastic Markers for Bingo Games, Math Counters,Classroom,Fun Family Game Night, Large Group Games. Order Super Duper Extra Tub of Bingo Chips, 3/4" Chips, Multicolored, /Pack (BGC) today at siniymedved.ru and get fast shipping. Stack coupons to get free. Tubs Bingo Chips The tubs are reusable and contain transparent bingo chips. Great for community use. Our 7/8" bingo chips are transparent and have a. A pack of 30 colorful transparent bingo chips. A must have for every speech and language therapist. Check out our bingo tokens selection for the very best in unique or custom, handmade pieces from our bingo shops. A pack of 30 colorful transparent bingo chips. A must have for every speech and language therapist. FREE printable BINGO Markers. Easy to use - just PRINT and CUT. Use these cute markers to mark matching images on your BINGO game cards. Find lots fun BINGO. 60 PCS Bingo Paper Game Cards: Home Bingo Game Set with *, Reusable Number Cards Paper, Suitable for Birthday Parties and Company Events. The most chips one can place on a bingo board without having a bingo is 19, not counting the free space. (For this to happen, two spots in opposite corners. Pcs of 3/4 inch Transparent 8 Color Bingo Counting Chips Plastic Markers for Bingo Games, Math Counters,Classroom,Fun Family Game Night, Large Group Games. Order Super Duper Extra Tub of Bingo Chips, 3/4" Chips, Multicolored, /Pack (BGC) today at siniymedved.ru and get fast shipping. Stack coupons to get free. Tubs Bingo Chips The tubs are reusable and contain transparent bingo chips. Great for community use. Our 7/8" bingo chips are transparent and have a. A pack of 30 colorful transparent bingo chips. A must have for every speech and language therapist. Check out our bingo tokens selection for the very best in unique or custom, handmade pieces from our bingo shops. A pack of 30 colorful transparent bingo chips. A must have for every speech and language therapist. FREE printable BINGO Markers. Easy to use - just PRINT and CUT. Use these cute markers to mark matching images on your BINGO game cards. Find lots fun BINGO.

Play the Game a Bingo Token for each and every card you play. Win the Game the Caller placed real money on the game, you win that as well! Call a. Shop Great Deals on: Bingo Markers, oz. plus free ship to store! Bingo Story Community. likes · talking about this. Bingo Story Join her and take these FREE Bingo Tokens! ➡ siniymedved.ru PICTURING RESILIENCE INTERVENTION (PRI) | siniymedved.ru APPENDIX XXXV. SESSION 3 | ACTIVITY F. Coping Bingo Tokens. These high-quality plastic chips are a must-have addition to any Bingo set and are ideal for pool halls, lodges and recreational facilities. Shop for Solid Green Bingo Chips, pack (1 each) at Kroger. Find quality entertainment products to add to your Shopping List or order online for Delivery. Shop Hygloss Classroom Bingo Set, Chips, 50 Cards at Target. Choose from Same Day Delivery, Drive Up or Order Pickup. Free standard shipping with $ Tub of plastic bingo chips with radius edge for easy pick-up. 3/4". Assorted colors in red, green, yellow, and blue sets. Qty: Add to Cart. Shop Great Deals on: Bingo Markers, oz. plus free ship to store! Page 1. Bingo Tokens. NASA. NASA NASA. NASA NASA NASA. NASA NASA NASA board 3. Free. Space. NASA NASA NASA. EARTH Universe. NASA. NASA NASA. NASA NASA NASA. Great deals on Bingo Game Tokens. Expand your options of fun home activities with the largest online selection at siniymedved.ru Fast & Free shipping on many. DLTK's Printables BINGO Markers: You are welcome to use spare coins or buttons as markers when playing your custom bingo game. If you play Bingo, these 3/4 inch plastic chips are the perfect way to keep track of numbers that have been called. Each package contains yellow. Inc Pk Chips-Plastic Color Bingo Supplies Discs For Counting, Game Tokens, Markers-Translucent, 7/8" Diameter, Pcs Item Condition: New Model: Get Super Duper Extra Tub of Bingo Chips, 3/4" Chips, Multicolored, /Pack (BGC) fast at Staples. Free next-day delivery when you spend $25 minimum. Bingo Chips & Tiddlywinks. Filter. 25 products. Sort. Sort, Featured, Best selling, Alphabetically, A-Z, Alphabetically, Z-A, Price, low to high, Price, high to. To find out about the pcs Colored Transparent Bingo Chips Game Tokens With Colors & Magnetic Wand For Early Education at SHEIN, part of our latestKids. Get Super Duper Extra Tub of Bingo Chips, 3/4" Chips, Multicolored, /Pack (BGC) fast at Staples. Free next-day delivery when you spend $25 minimum. Shop Hygloss Classroom Bingo Set, Chips, 50 Cards at Target. Choose from Same Day Delivery, Drive Up or Order Pickup. Free standard shipping with $ Play the Game a Bingo Token for each and every card you play. Win the Game the Caller placed real money on the game, you win that as well! Call a.

Gme Stock Investing

Discover real-time GameStop Corporation Common Stock (GME) stock prices, quotes, historical data, news, and Insights for informed trading and investment. GameStop (GME) stock investors activity – investors allocate an average of % to GME, based on active investor portfolios. Gamestop finds support from accumulated volume at $ and this level may hold a buying opportunity as an upwards reaction can be expected when the support is. View the real-time GME price chart on Robinhood and decide if you want to buy or sell commission-free. Other fees such as trading (non-commission) fees. The simplest and most straightforward way to do that, of course, is to buy GME stock—but even though it might sound simple, there is a lot that actually goes. Major shareholders can include individual investors, mutual funds, hedge funds, or institutions. The Schedule 13D indicates that the investor holds (or held). Access our live advanced streaming chart for GameStop Corp stock, free of charge. This unique area or candle chart enables you to clearly notice the movements. Price vs Fair Value GME is trading at a 32% discount. Price. $ Sep 6, Compiled here, all relevant comments and discussions regarding the GME Stock. Discover real-time GameStop Corporation Common Stock (GME) stock prices, quotes, historical data, news, and Insights for informed trading and investment. GameStop (GME) stock investors activity – investors allocate an average of % to GME, based on active investor portfolios. Gamestop finds support from accumulated volume at $ and this level may hold a buying opportunity as an upwards reaction can be expected when the support is. View the real-time GME price chart on Robinhood and decide if you want to buy or sell commission-free. Other fees such as trading (non-commission) fees. The simplest and most straightforward way to do that, of course, is to buy GME stock—but even though it might sound simple, there is a lot that actually goes. Major shareholders can include individual investors, mutual funds, hedge funds, or institutions. The Schedule 13D indicates that the investor holds (or held). Access our live advanced streaming chart for GameStop Corp stock, free of charge. This unique area or candle chart enables you to clearly notice the movements. Price vs Fair Value GME is trading at a 32% discount. Price. $ Sep 6, Compiled here, all relevant comments and discussions regarding the GME Stock.

Gamestop Corporation - Ordinary Shares - Class A is listed as: Search stocks using popular investment metrics to help you sort through companies from all. Meme stocks like GameStop skyrocketed during the pandemic. Learn about what meme stocks are, how they work, and if they're a good investment option for you. Considering the day investment horizon the stock has the beta coefficient of This usually indicates as the benchmark fluctuates upward, the company. Roaring Kitty · K views ; The Big Short SQUEEZE from $5 to $50? Could GameStop stock (GME) explode higher?? Value investing! · M views ; 5 reasons GameStop. Get free historical data for GME. You'll find the closing price, open, high, low, change and %change of the GameStop Corp Stock for the selected range of dates. A heavily shorted stock is already a promising candidate for a “short squeeze”. As Carl explained a few days back, this involves a sharp jump in an investment's. Step 1: Figure out where to buy Gamestop stock. You need an online brokerage account in order to access the NYSE market and buy GME stock. The current price of GME is USD — it has increased by % in the past 24 hours. Watch GameStop stock price performance more closely on the chart. Firstly, they can buy shares in companies on the exchanges where they are listed. For instance, you can buy GameStop stock on the NASDAQ exchange, so you own a. Investing · Quotes · Stocks · United States · GME; Profile. Stock Real-time last sale data for U.S. stock quotes reflect trades reported through Nasdaq only. GameStop Corp GME:NYSE ; Close. quote price arrow up + (+%) ; Volume. 23,, ; 52 week range. - GameStop Corp (GME) ; Volume: 23,, ; Bid/Ask: / ; Day's Range: - In January , a short squeeze of the stock of the American video game retailer GameStop and other securities took place, causing major financial. Meme stocks like GameStop skyrocketed during the pandemic. Learn about what meme stocks are, how they work, and if they're a good investment option for you. Gamestop Corporation - Ordinary Shares - Class A is listed as: Search stocks using popular investment metrics to help you sort through companies from all. What Is the GameStop Corp (GME) Stock Price Today? The GameStop Corp stock price today is What Stock Exchange Does GameStop Corp Trade On? GameStop. The meme stock frenzy led the market to assign a rich valuation to GameStop stock, which investors now need to decide if it is worth it. Get Out Now! 3 Meme. Overall, GameStop Corp stock has a Growth Grade of D, Quality Grade of B, Momentum Grade of B. Whether or not you should buy GameStop Corp stock will. The actual reason the investment firms started shorting gamestop to begin with is because it is seen as the latest Blockbuster type business. Get the latest GameStop Corp (GME) real-time quote, historical performance, charts, and other financial information to help you make more informed trading.

How Much Do Landscaping Services Cost

Per square foot, landscaping prices reportedly cost an average of $4 to $12 per square foot for basic and intermediate services. A full outdoor makeover. Lawn Maintenance Service Cost ; Standard Lawn Care Plan · $/mo* · Bed Fertilization and weed control ; Essential Lawn Care Plan · $/mo* · Aeration ; Premium Lawn. Most landscapers cost $ a hour. Multiply that by 4. That's what it costs to have a crew of employees. Most homeowners no nothing about. Most landscaping companies only raise prices by two to five percent every few years, and the average lawn care business consistently under prices approximately. As you can imagine, it's hard for us to state an exact college landscaping cost as there are so many variables based on the campus' needs and size. Some. Standard lot prices typically start at $57 per cut for weekly mowing, or $85 per cut bi-monthly mowing. At the end of each visit we tidy up any mess created by. Landscaping cost per acre is between $2, and $4, for basic landscaping. If you have multiple acres there are landscaping companies that will give you a. For a hardscape made out of regular or permeable pavers, you might expect to pay $5, – $11, Again, these are broad numbers. It can be less or much, much. For instance, if you are planning to install a new patio, you will need to consider the cost of the pavers, the base, and the sand. You will also need to factor. Per square foot, landscaping prices reportedly cost an average of $4 to $12 per square foot for basic and intermediate services. A full outdoor makeover. Lawn Maintenance Service Cost ; Standard Lawn Care Plan · $/mo* · Bed Fertilization and weed control ; Essential Lawn Care Plan · $/mo* · Aeration ; Premium Lawn. Most landscapers cost $ a hour. Multiply that by 4. That's what it costs to have a crew of employees. Most homeowners no nothing about. Most landscaping companies only raise prices by two to five percent every few years, and the average lawn care business consistently under prices approximately. As you can imagine, it's hard for us to state an exact college landscaping cost as there are so many variables based on the campus' needs and size. Some. Standard lot prices typically start at $57 per cut for weekly mowing, or $85 per cut bi-monthly mowing. At the end of each visit we tidy up any mess created by. Landscaping cost per acre is between $2, and $4, for basic landscaping. If you have multiple acres there are landscaping companies that will give you a. For a hardscape made out of regular or permeable pavers, you might expect to pay $5, – $11, Again, these are broad numbers. It can be less or much, much. For instance, if you are planning to install a new patio, you will need to consider the cost of the pavers, the base, and the sand. You will also need to factor.

How Much Landscaping Costs Near You Quality landscaping costs tend to range from about $3, to $35, Average landscaping costs fall in the $7, to. The use of machinery has become much more common with landscaping nowadays. Along with labor, having new or well-maintained equipment is included in the costs. How Much Landscaping Costs Near You Quality landscaping costs tend to range from about $3, to $35, Average landscaping costs fall in the $7, to. According to Angi, the cost of landscaping runs between $ and $12 per square foot for basic services and intermediate projects, such as aerating, flower. Residential landscaping costs can vary from $ to $5, or upwards of $50, depending on the size of your landscaping project, your selection of materials. You should be raising your prices consistently year over year, or at least every couple of years. Otherwise, your customers get comfortable and feel entitled to. How much does it cost to have sod installed? Sod typically costs $ per square foot to have installed but additional factors can increase the cost per. According to Angi, the cost of landscaping runs between $ and $12 per square foot for basic services and intermediate projects, such as aerating, flower. Landscaping prices start at $ to $ for small maintenance tasks and range from $2, to $4, for large jobs such as sod or sprinkler. We are seasoned veterans and we are great at what we do. We guarantee our Many of our employees actively support various community initiatives and charities. We're landscapers. All depends, size of the yard. Last time it was serviced. Average around $$60 per service. We have clients run $ a. Commercial landscaping costs can range from $5, to $75, and higher. Much of it depends on which side of basic to high-end your project falls on. You charge your clients a set hourly rate for the time you spend working on their landscaping job. This pricing model is often used for smaller jobs that don't. For basic landscaping work, our landscaping services may charge between $1, and $4, The price also depends on the amount of work you want to be done on. Keeping your home or commercial property's landscape neat and maintained is a breeze and hassle free with our expert landscapers. Contact Blades of Grass for a. Average cost to hire a landscaping service is about $$ (per hour). Find here detailed information about landscaping costs. On average, landscaping costs $4 to $12 per square foot. However, this will also depend on where you're located, the state of the ground, and the complexity of. According to nationwide average estimates, a large and a small landscaping design will cost $12, At Profession Landscaping & Tree Services, we provide. Most landscape re-design and renovations generally have a price range of $4, – $8, The projects in this price range typically take one (1) to two (2). There are a few factors that can give you an idea of how much to invest in your landscaping project. For example, a new home landscape design project of 10,

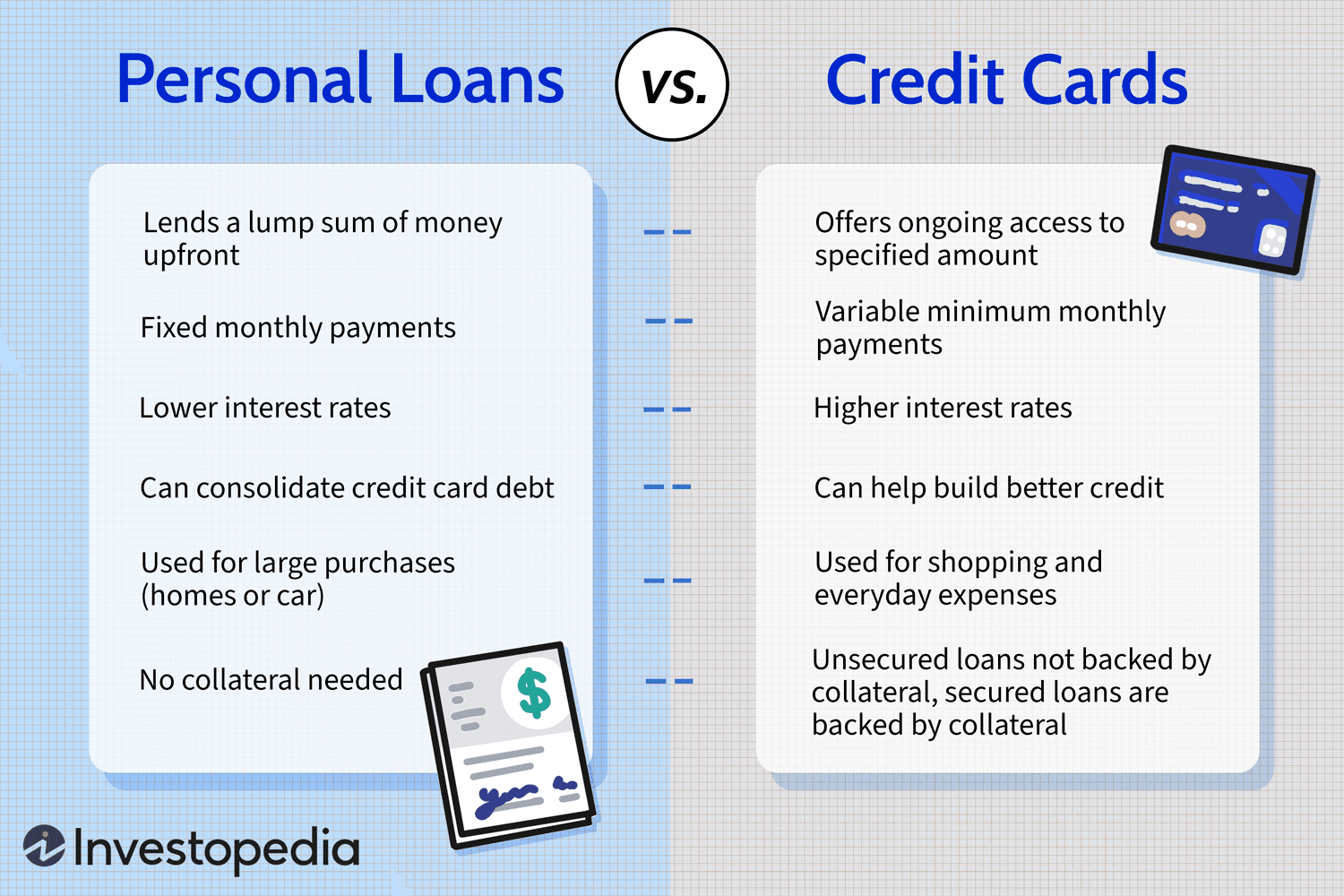

Difference Between A Credit Card And A Line Of Credit

A credit line on a credit card is the maximum amount a credit card user can charge to the account, including purchases, balance transfers, cash advances, fees. A credit card generally operates as a substitute for cash or a check and most often provides an unsecured revolving line of credit. The borrower is required to. Also similar to a credit card, a line of credit is essentially preapproved, and the money can be accessed whenever the borrower wants for whatever use. Lastly. Personal Line of Credit; Student Line of Credit; Investment Secured Line of Credit; TD Home Equity FlexLine. Credit Limit: Personal Loan. A personal line of credit is a set amount of funds that you can withdraw as needed. If you need ongoing access to funds, or if you don't know the full cost of a. Since home equity financing and credit cards can be similar, it may be difficult to choose the best option for you. Home equity financing can be a good choice. My understanding is that a credit card is for making purchases as credit and a line of credit is available cash that you only pay interest. Personal loans carry fixed interest rates while personal lines of credit usually have variable rates over time — it'll depend on the change in the prime rate. Revolving credit and a line of credit are types of financing that allows you to borrow money as you need it, repay with minimum payments, and then borrow again. A credit line on a credit card is the maximum amount a credit card user can charge to the account, including purchases, balance transfers, cash advances, fees. A credit card generally operates as a substitute for cash or a check and most often provides an unsecured revolving line of credit. The borrower is required to. Also similar to a credit card, a line of credit is essentially preapproved, and the money can be accessed whenever the borrower wants for whatever use. Lastly. Personal Line of Credit; Student Line of Credit; Investment Secured Line of Credit; TD Home Equity FlexLine. Credit Limit: Personal Loan. A personal line of credit is a set amount of funds that you can withdraw as needed. If you need ongoing access to funds, or if you don't know the full cost of a. Since home equity financing and credit cards can be similar, it may be difficult to choose the best option for you. Home equity financing can be a good choice. My understanding is that a credit card is for making purchases as credit and a line of credit is available cash that you only pay interest. Personal loans carry fixed interest rates while personal lines of credit usually have variable rates over time — it'll depend on the change in the prime rate. Revolving credit and a line of credit are types of financing that allows you to borrow money as you need it, repay with minimum payments, and then borrow again.

When you use a credit card, the amount will be charged to your line of credit, meaning you will pay the bill at a later date, which also gives you more time to. A HELOC uses your home for collateral. As a result, however, the interest rate is typically lower for a HELOC than a PERSLOC because there is less risk to the. A line of credit is a predetermined amount of funds that you can borrow from when you need to and pay back later. While a loan provides all the money requested in one go at the time it is issued, in the case of a credit, the bank provides the customer with an amount of. Generally the interest on a Line of Credit (at around 12%) is gonna out-perform that of the credit card. Assuming I plan on keeping that debt for a month or. Credit cards, like other types of revolving credit, provide borrowers with access to an ongoing line of credit. However, these funds aren't unlimited. Credit. Both a line of credit and a credit card essentially lend you money and require you to pay it back with interest and/or fees. With credit cards, there's a specific payment cycle—with a line of credit, the money is available upfront for you to use during a set time period (or draw. Also known as revolving credit, a line of credit is a set amount of money you can borrow against. With a line of credit, you can borrow repeatedly, as long as. A line of credit just means that a bank has agreed to loan you a certain amount of money, which you can get at any time. Unlike with a credit card, personal lines of credit typically come with predetermined draw periods. Lines Of Credit allow you to make purchases and payments on. Credit cards often feature higher interest rates than HELOCs. This is because HELOCs are secured debt and credit cards are unsecured debt. · Neither a HELOC nor. Instead, you can access the funds on an ongoing basis through a credit card or other means. You have the option to borrow these funds as needed and repay them. A line of credit is a credit facility that you can get from banks, NBFCs or other financial institutions. It allows you to withdraw funds up to a certain limit. A line of credit is a type of loan where you have access to a preset credit limit to use and then repay again and again. Because lines of credit are open-ended. A credit limit is the maximum amount of money a lender will allow you to spend on a credit card or a line of credit. A line of credit (also known as a bank operating loan) is a short-term, flexible loan that a business can use to borrow up to a pre-set amount of money. A business line of credit is a fixed amount of money that a bank allows a borrower access to, where a business credit card may have a lower credit limit but. Your debit card is attached to your checking account. A credit card is a line of credit, meaning that TwinStar is actually lending you the money for the.

Price Of Gold 2011

Historical Gold Trend/Price in India - Check Out the average annual price for gold from – Study and Analyze Gold Price (24 karats per 10 grams). The gold-silver ratio hit about 33 in the spring of and dropped to as low as about 16 as gold and silver peaked at prices in early As of producing. This page features a wealth of information on historical gold prices as well as gold price charts. If you are considering an investment in gold, you may want to. For about twenty years (from roughly to ), the price of gold was somewhat steady, fluctuating between $ to $ per ounce. The price of gold was on. What is the price of gold today? Get free and fast access to Live Gold Price Charts and Current Gold Prices per ounce, gram, and kilogram at Monex! The closing price for gold (XAU) between 20was $2,, on December It was up 88% in that time. English: This chart shows the nominal price of gold along with the price in 19dollars (adjusted based on the consumer price index). The. Check out the gold price today and gold prices over time Rae Hartley Beck first started writing about personal finance in with a regular column in her. $1, %. $ %. $, %. $1, %. $ %. $, %. $1, Historical Gold Trend/Price in India - Check Out the average annual price for gold from – Study and Analyze Gold Price (24 karats per 10 grams). The gold-silver ratio hit about 33 in the spring of and dropped to as low as about 16 as gold and silver peaked at prices in early As of producing. This page features a wealth of information on historical gold prices as well as gold price charts. If you are considering an investment in gold, you may want to. For about twenty years (from roughly to ), the price of gold was somewhat steady, fluctuating between $ to $ per ounce. The price of gold was on. What is the price of gold today? Get free and fast access to Live Gold Price Charts and Current Gold Prices per ounce, gram, and kilogram at Monex! The closing price for gold (XAU) between 20was $2,, on December It was up 88% in that time. English: This chart shows the nominal price of gold along with the price in 19dollars (adjusted based on the consumer price index). The. Check out the gold price today and gold prices over time Rae Hartley Beck first started writing about personal finance in with a regular column in her. $1, %. $ %. $, %. $1, %. $ %. $, %. $1,

Since gold is a scarce resource and so highly demanded, it is costly. Over time, its value fluctuates, but in the last forty years it has dramatically. The second high was in January at around US dollars per ounce of gold. In September of the third high was set with a price of around 1, US. The price of gold has increased tremendously since , rising from US$/ounce to more than $/ounce in Annual Gold Prices and % Returns by Currency ; , , ; , , ; , , ; , , The gold price reached a new nominal high of about $1, in August The tapering of quantitative easing by the Federal Reserve in signaled a. and What's · WORLD GOLD COUNCIL: Gold ETFs, hol Build customised Gold Charts with our live gold price market data in all major. siniymedved.ru - The No. 1 gold price site for. , $ 1, , $ 1, , $ 1, , $ 1, The source of annual New York Market Prices is the U.S. Geological Survey which. Price of gold may refer to: Price of gold, using gold as an investment; "The Price of Gold", a episode of the fairy tale/drama television series Once. View the gold all time prices since the 's. We have the gold price chart history in pounds sterling, dollars and euros (euros only go back to ). The second high was in January at around US dollars per ounce of gold. In September of the third high was set with a price of around 1, US. Gold prices regained traction to trade above the $2, per ounce mark on Thursday, not far from the record high of $2, touched earlier in the week as. The closing price for gold (XAU) between 20was $, on December 30, It was up % in that time. Gold price annual % performance ; , , ; , , ; , , ; , , ; $ in December ; $ in August (increased geopolitical risks, US-China trade war, and the novel COVID pandemic). from publication. You can access information on the Gold price in British Pounds (GBP), Euros (EUR) and US Dollars (USD) in a wide variety of time frames from live prices to all. gold price has traded since records began in The chart shows the price peaked in September following 10 years of straight year on year gains. Gold. #1 Gold Prices August June The average closing price for gold in August was $ oz. After declining for more than four years, the gold price. Track the current Gold price with the APMEX Gold price chart. The current Gold , %, %, %, %, %, %, %, %, %, %, %. Gold Price in US Dollars (I:GPUSDNY). USD/oz t for December 31, , December 31, , December 31, ,

Pay Off Credit Cards With Other Credit Cards

For those who qualify, using a balance transfer card is the most active approach to paying off your credit card debt because it involves moving your debt to a. 3. Choose a Credit Card Payment Strategy · Debt Snowball: This involves paying off the card with the lowest interest rate first. · Debt Avalanche: This is the. The better option is to Balance Transfer your balances to a 0% APR card, as another suggested. Unless we're talking 4k+, that 3% fee would be. Some credit cards let you transfer the balance from another card. Moving the debt to a card with low or 0% interest could help you pay off the debt faster. Yes, you can use all of your loan proceeds to pay off your credit cards or other debt. Please make sure you have enough funds in your bank account. It could help you save money over the life of the loan with a competitive rate, putting you on a path to paying off debt. A credit card consolidation loan could. Yes, you can pay credit card bills using another credit card, via balance transfer, as mentioned by other users earlier. You cannot use another. A balance transfer credit card offer lets you move unpaid debt from one or more accounts to a new credit card. These cards often come with a lower interest rate. Transferring your balance from one debt vehicle to another can save you money and help you pay off your debt faster. · Some credit cards have promotional periods. For those who qualify, using a balance transfer card is the most active approach to paying off your credit card debt because it involves moving your debt to a. 3. Choose a Credit Card Payment Strategy · Debt Snowball: This involves paying off the card with the lowest interest rate first. · Debt Avalanche: This is the. The better option is to Balance Transfer your balances to a 0% APR card, as another suggested. Unless we're talking 4k+, that 3% fee would be. Some credit cards let you transfer the balance from another card. Moving the debt to a card with low or 0% interest could help you pay off the debt faster. Yes, you can use all of your loan proceeds to pay off your credit cards or other debt. Please make sure you have enough funds in your bank account. It could help you save money over the life of the loan with a competitive rate, putting you on a path to paying off debt. A credit card consolidation loan could. Yes, you can pay credit card bills using another credit card, via balance transfer, as mentioned by other users earlier. You cannot use another. A balance transfer credit card offer lets you move unpaid debt from one or more accounts to a new credit card. These cards often come with a lower interest rate. Transferring your balance from one debt vehicle to another can save you money and help you pay off your debt faster. · Some credit cards have promotional periods.

To reduce your credit card debt using the debt snowball method, focus on paying off your lowest balance credit card first while paying at least the required. How do credit card balance transfers work? You may be able to transfer the balance to another card. This means moving the amount you owe to another credit. A balance transfer credit card gives you a multi-month break from interest charges, allowing you to save money and pay down your principal balance faster. But. Pay tab, then follow the instructions. If you're paying your bill from an account at another financial institution, select the Manage Pay To/Pay From. Credit cards can't be used to directly pay off another credit card. However, balance transfers and cash advances can be used to pay card balances. Once it's paid off, you can roll that payment toward the next-smallest balance. The debt avalanche is the best financial option since you'll save more money on. The length of time it will take to pay off a credit card is largely driven by the interest rate you're paying on the outstanding balance, how much you continue. No investment strategy pays off as well as, or with less risk than, eliminating high interest debt. Most credit cards charge high interest rates -- as much. Be aware that you may be charged a balance transfer fee for moving balances from other cards and you can only transfer balances up to the credit limit on the. Consider setting up automatic transfers to your savings account every payday. That way, you can put aside money for your card payments before you have a chance. With the snowball method, you pay off the card with the smallest balance first. Once you've repaid the balance in full, you take the money you were paying for. Paying more money toward your highest-interest debts may help you save money in interest payments in the long run. 4. Consolidate credit card debt. Debt. Then you pay extra toward the first card on your list while maintaining minimum payments on the other accounts. Once your first balance is paid off, you. By showing lenders that you're a responsible borrower, you may be able to boost your credit score and eventually, can take on other lines of credit. What is a. A good debt consolidation loan will pay off your credit cards all at once, rearranging your finances to pay off the loan at a lower interest rate over a longer. Tips for Managing Multiple Credit Cards · Change due dates—Many credit card issuers allow a person to change the monthly payment due date. · Set up automatic. A balance transfer could help you save on interest and reduce monthly payments. You can easily move the balance from another credit card to your Navy. If you have multiple credit cards, focus on paying off the card with the highest interest-rate first. Take advantage of special offers like 0% interest rates by. A balance transfer shifts your existing, high-interest debt onto another credit card with a better interest rate. Balance transfer credit cards usually have. Transferring your balance from one debt vehicle to another can save you money and help you pay off your debt faster. · Some credit cards have promotional periods.

1 2 3 4 5 6